What Exactly is a Debt Review Clearance Certificate?

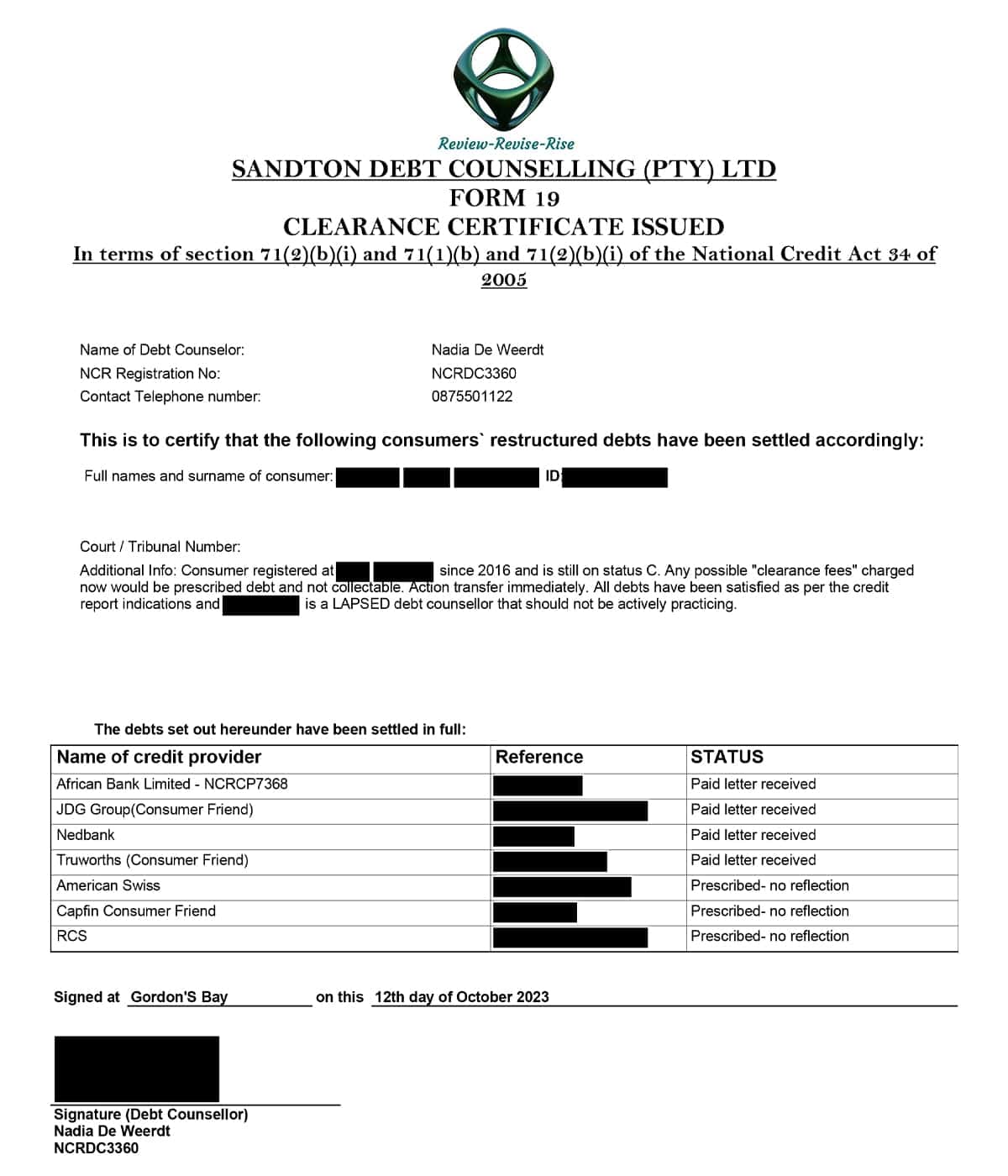

A Debt Review Clearance Certificate is a formal document, recognized by The National Credit Regulator. This document is also called a Form 19 and affirms your successful completion of the debt review or debt counselling process, as prescribed by the National Credit Act (NCA).

To be valid, this document must be issued exclusively by registered debt counsellors (DC). This certificate holds immense significance as it indicates that you have met the stringent criteria set forth during your debt review journey.

How to get a debt review clearance certificate

To receive this coveted document, certain prerequisites must be fulfilled:

- Debt Counselling Fees: All fees related to debt counselling must be settled in full.

- Settlement of Restructured Accounts: Every account restructured under the debt repayment plan, including personal loans, credit cards, store credit, and other financial obligations, must be completely settled.

- Home Loan Considerations: Your home loan or bond does not have to be settled. You only need to be financially capable of paying the original instalments after receiving the clearance certificate.

Below is a sample of the debt clearance certificate

The below clearance certificate was for a client whose debt counsellor was de-registered, yet still trying to extort fees for an illegitimate clearance. We help many consumers who struggle to get cleared from debt counselling.

Please be aware, it will not work to download this document and put your own details on it. We have experienced this type of situation, and would like to remind all consumers that it is a criminal offense eg. FRAUD to attempt to do your own clearance in this way.

As stated in this article, there are many fail-safes in place to confirm a legitimate clearance.

How does the debt review clearance work?

Throughout the process of debt counselling, your file will be periodically updated. The debt counsellor will request paid up letters from the credit providers as soon as an account is settled. Once all accounts are settled, the debt counsellor will update your debt review status on the NCR database, called the Debt Help System, where the 1st flag will be removed.

The clearance certificate will now be printed, certified, and sent to all the registered credit bureaus and the listed credit providers. You will also receive a copy. Both the credit providers and bureaus will then remove the status flag against your name, on their systems.

How long does the debt clearance take?

To get the flag removed from your credit profile usually takes between 2 to 4 weeks. The period depends on how busy the credit buraus are at that stage.

It is important to mention that there are technically 3 flags against your name when the process starts.

- On the Debt Help System at the NCR

- At the credit bureaus

- At the credit providers

The flag at the credit providers is a safeguard of sorts, as many consumers have been scammed by unscrupulous individuals promising “debt clearance” and then issuing fake clearance certificates to credit bureaus.

How long after debt review can I buy a house or car?

Although your credit record will be clear within 4 weeks, we suggest that you wait for 2 to 3 months before applying for new credit.

Make sure you have some kind of active short term insurance policy and keep payments up to date. This is the fastest way to grow your credit score.

Alternatively, you could apply for a store or clothing account and utilize below 50% of the balance for 2 to 3 months. After this, you will be good to go!

In conclusion:

A Debt Review Clearance Certificate is not merely a document; it’s a testament to your resilience and determination in overcoming financial adversity.

As you emerge from the debt review process, armed with this certificate, remember that financial freedom is not just a dream; it’s a tangible reality within your grasp. Stay patient, stay vigilant, and soon you’ll find yourself on the path to a brighter, debt-free future.